Capital (funds). Circulation and turnover of capital

Lecture 6 Capital (funds). Circulation and turnover of capital.

Lecture outline

Subtopic 1 Circulation and turnover of an entrepreneurship capital and funds.

Subtopic 2 Fixed and variable capital. Depreciation.

Subtopic 3 Investment as a financing source for production funds.

Investment structure.

Subtopic 4 Wage: essence, types. Factors that determine the level of wage

Capital is the resources used in creation goods and services in the long term. Physical capital is the machinery, equipment and buildings used in production. Each type of enterprise has funds to organize and make goods or services. The funds are divided to production funds and circulation funds.

Production funds consist of production (production means such as machine tools, computers, working tables and others) funds and non-production funds (accommodation, sanatorium, health centre and others).

Production funds have direct relation to the production process, but non-production funds also important part of the funds as they influence to labour productivity at the enterprise.

Circulation of Capital is the movement of automatically growing value in production and distribution, during which the capital assumes three functional forms (monetary, productive, and commodity) and passes through three stages. At the end of the process, the capital returns to its initial form.

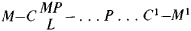

The first stage of the movement of industrial capital is the conversion of monetary capital (M) into productive capital, that is, the purchase of commodities (C); these commodities are composed of the means of production (MP) and labor (L). This stage is expressed by the formula

Capital passes through the first stage in the sphere of circulation: the purchase of a specific commodity, labor, converts money into capital that is returned to its owner in an amount exceeding the initial capital value by the magnitude of the surplus value. Thus, monetary capital expresses the relations between two classes in bourgeois society: the workers, who are deprived of the means of production and forced to sell their labor, and the capitalists, the owners of the means of production.

The condition for the conversion of money into capital is the existence of a specific commodity, labor, in the market. In the first stage of the circulation of capital, no growth in value occurs. The second stage of the circulation of capital, the conversion of productive capital into commodity capital, takes place in the production sphere and is expressed by the formula … P …, where P stands for the process of production. This stage is characterized by growth in capital value. The function of capital in this form is to produce value and surplus value. The means of production become the material carrier of constant capital, whereas labor is the carrier of variable capital. The value of the commodity newly created in the production process already includes surplus value. The third stage is the conversion of commodity capital into monetary capital. It is expressed by the formula C’ — M’ and takes place in the distribution sphere. The function of commodity capital is the process of selling, that is, conversion of the produced value and surplus value from the commodity form into the monetary form. With the conversion of commodity capital into the monetary form, the circulation of capital is completed; capital begins a new circulation in its initial form, monetary capital.

Every individual unit of capital at any given moment is simultaneously in its three different functional forms and in the three different stages. The circulation of industrial capital thus represents a unity of three circulations. The movement of industrial capital is not limited to a single circuit. The continuous repetition of the circulation of capital forms the capital turnover. The continuity of circulation is determined by the conditions of capitalist reproduction and its laws. Monetary capital, being the initial form of industrial capital, completes its circulation according to the formula

The continuity of the circulation of monetary capital is an essential condition for continuity in the production of surplus value.

The chief function of productive capital is the exploitation of hired labor to produce surplus value. The formula of its circulation is P … C’— M’— C’ … P’. For the continuous movement of industrial capital the functioning of commodity capital must also be uninterrupted: C’—M’— C … P … C’. The most important expression of the circuit of commodity capital is the sales process, that is, selling the commodity with a profit for the capitalist. However, this process cannot be completed without sale of the commodities as use values. If the commodities produced do not satisfy society’s needs, they cannot be sold at a profit to the capitalist and the process of circulation may break down in the first stage.

The analysis of industrial capital in the unity of its three circulations, first done by K. Marx, completely characterizes the circulation of capital and reveals the conditions for its continuous movement. “Capital describes its circuit normally only so long as its various phases pass uninterruptedly into one another” (K. Marx, in K. Marx and F. Engels, Soch., 2nd ed., vol. 24, p. 60). In view of the antagonistic nature of capitalist production this continuity is constantly being disrupted and accompanied by crises; it is cyclical in nature. Because monetary, productive, and commodity types of capital fulfill different missions in the movement of industrial capital, they can separate to function independently. In a certain stage of the development of capitalism, monetary capital, in the form of loan capital, becomes separate from industrial capital, and commodity capital does the same in the form of commercial capital. The separation of these forms of capital complicates the movement of industrial capital and aggravates the contradictions of capitalist economic reproduction.

Circulation funds consists of stock-produced goods (готовая, нереализованная продукция) and money funds(to buy raw materials, fuel, electricity and others).

There are three forms funds such as the production funds, goods funds, money funds. These funds have to be in a continuous circulation. The process of the continuous circulation is called turnover of the capital and it expresses through the formula

M-G- prod.means-… P… G’-M’

Labour force

M- money funds of the firm

G- production means (production building, construction, computers and others)

… - time

P- Production process

G’- goods funds (prepared goods but not has not sold yet)

M’- money after selling the goods.

The capital is divided to main (fixed) and auxiliary (variable) forms according to their turnover.

Fixed capital is the resources which are used in the production process in the long term and they give their value to the ready product little by little (постепенно).

e.g/ production building, construction, computers and others

Variable capital is resources which are used totally in the production process at once. e.g. raw materials, fuel, additional materials and others.

Fixed capital takes part in the production process that’s why it became ancient and lose consumption value. This process is called depreciation.

Investment is the purchase of new capital goods by firms. Saving is that part of income which is not spent buying goods and services.

Investment sources are free money of people, profit of the domestic enterprises and foreign enterprises and others

The level of investment depends on the following factors: level of profit, interest rate, tax rate, and political, economical stability in the society.

There are two groups of investment. They are

- A finance and real investment

- A direct and portfolio investment

The finance investment is the money of government, private companies which are directed to buy shares (акции), bonds (oблигации) and other securities

The real investment is the money which is directed to increase real production means.

The direct investment is the money of foreigners to the national economy.

The portfolio investment is the money which is directed to buy foreign companies’ shares, bonds and others. A portfolio investment is a passive investment in securities, none of which entails in active management or control of the securities' issued by the investor. Portfolio investment is investment made by an investor are not particularly interested in involvement in the management of a company.

It is also the investment in securities that is intended for financial gain only and does not create a lasting interest in or effective management control over an enterprise.

It includes investment in an assortment or range of securities, or other types of investment vehicles, to spread the risk of possible loss due to below expectations performance of one or a few of them.

The investment structure includes all the costs which are used in the process of building, construction, purchasing of machinery, tools and etc.

Capital (funds). Circulation and turnover of capital