Compare and contrast the process of global economic integration that has taken place over the past half century with that of previous periods in the history of the world

anja Jrgensen International Trade May 2014

Compare and contrast the process of global economic integration that has taken place over the past half century with that of previous periods in the history of the world.

In order to be able to compare and contrast the procesess of economic integration that took place and continue to take place in the world and to answer the question of the assignment, we will have to structure the assignment in the way, where we can look at the integration processes before and after World War 2.

The practical structure of the assignment will thus be as follows :

0.Introduction

1. Processes in the world in the previous periods in the history of the world.

2. Compare and contrast the intgration processes in the world before and after WW2.

3. Conclusion

0. Introduction

The economic integration is an effective form of economic organization. Also, the economic integration on the world level promotes the creation of favourable political atmosphere. The global economic integration creates various forms for economic relationships between countries, where there is a combination of the cooperation and the competition ; and market relations are replaced by contract-market relations. One of the important consequences of the global integration is the creation of the necessary conditions for the international manufacturing cooperation, which is a form of organization of manufacturing activity that includes participation on the basis of manufacturing specialization of several countries, where these countries cooperate with each other. The international manufacturing cooperation displays a highest level of specialization and cooperation. In order to better understand the concept of the international manufacturing cooperation, it is necessary to understand the following moments that are typical for this form of organisation :

- High efficiency of manufacturing, higher level of output

- Long term and more stable relations between partners

- Close international cooperation in the field of research and development (R&D)

- Same targets and same projects

The R&D cooperation between countries has a special place in the processes of the international economic integration as this becomes a crucial parameter for the further development of the manufacturing processes and the economy in the whole. Many of the R&D projects today are of very high costs - the cost of the specialists, expensive laboratories and research programmes, which one company - no matter how big it is – often can not afford on its own. In order to make the necessary R&D companies and sometimes even whole countries cooperate and combine their efforts, both human resources and capital. For example, space programmes of Japan, Canada, Germany that cooperate with USA and Russia on this.

When several companies or countries combine their efforts in this way, they have a huge opportunity to achieve a progress, which would not be possible if they had to achieve this on their own. In this way the economic effect of such a cooperation is very big.

Later on in the assignment we will discuss these theoretical points applied to the actual processes happening in the world since World War 2.

There are following forms of the economic integration,which we are going to look at later on in this assignment:

Preferential zone is a trading bloc that gives preferential access to certain products from the participating countries. This is done by reducing tariffs but not by abolishing them completely

Free trade zone is the simplest and the most common form of economic integration, within the limits of which all the trade limitations (and first of all customs dues) for participant countries are cancelled.

The creation of the free trade zone increase a competition between national and foreign manufacturers on the domestic market, which increases a risk of bankruptcies on one hand, but contributes to the development and optimization of the manufacturing processes and promotes innovation on the other hand. Cancellation of the customs dues and other limitations are as a rule applied to manufactured goods. As far as agriculture is concerned, the liberalization of import is still limited here. This kind of free trade zone was typical for European Union, and is being observed in the North American region and Latin America too. All this will be discussed later in the assignment.

Customs Union implies the establishment of a single external tariff and implementation of a unified foreign policy in relation to third countries.Customs unions are often combined with a payment union that provides a mutual convertability of the currencies or one currency.

Economic Union comprises common market – is a complicated form of market, which provides free capital and labour movements within its boundaries, besides free trade and common tariff for external trade.

Economic and currency union is the highest form of inter-country economic integration, which combines all above-mentioned forms of integration with a general economic and a monetary policy. This type of a union can be found only in Western Europe. Only in Western Europe the process of economic integration has passed all the stages.

Advantages and disadvantages of economic integration

The advantages of the economic integration are following:

- increase in the size of a market - a manifestation of the scale of manufacturing;

- increased competition between countries

- better trading conditions

- increased trade and improvement of infrastructure

- development of new technologies

The disadvantages can be :

- for less developed (developing) countries the economic integration leads to an outflow of resources (factors of manufacturing), a redistribution happens in a favour to the developed countries

- oligopoly of MNCs of the participating countries, which contributes to higher prices for goods;

1. The processes of economic integration in the world before World War 2.

The world economy started from the world trade. World countries traded with each other in order to receive the products they needed. The trade between countries contributed to the development of many industries, which in its turn has contributed to the development of the international trade.

Discovery of new countries – emergence of new markets

A great contribution to the world trade of goods and services was made by the developmentof market relations and the great geographical discoveries of XV - XVII centuries, the emergence in the XIX century of machine-manufacturing industries and modern means of transport and communications.

The expeditions of Columbus, Vasko da Gama, Magellan and others have broadened the limits of the world adding the new regions to it.

New inventions - machine-manufacturing, new ways to communication, new transport means

The economic relations with these new regions became solid after the mass manufacturing of the consumer goods became available in XIX century first in Western Europe and then in North America, Russia and Japan. These were simple and cheap consumer goods. The invention of steamships, railsways and telegraph boosted the international trade. In that way the world market of goods and services has been formed by the end of XIX century.

Movement of manufacturing factors

At the same time the movement of manufacturing factors started to increase in the world (the movement of capital, labour, business people, technologies). All these factors moved in one direction – from the developed countries to the developing. British, French, Belgian, Dutch and German capital were the significant elements of the capital structure in Americas, Africa, Australia.

Later on the process of movement of economic resources has become more complex – the capital, business people and technologies were not only imported but also exportede by the mid-developed countries, as well as the less-developed countries started to actively export labour. As a result, the international movement of manufacturing factors became mutual.

After that the world economy was formed at the turn of XIX-XX century , it has gone through several considerable changes. So, as a result, we have several stages of the modern economy development :

1) End of XIX – til World War 1. This is the period where the world economy became open. The trade of raw materials is more developed than the trade of ready made goods, but the role of exports had been constantly growing.

2) The period between World War 1 and World War 2. This period is characterized by a general unstability and many crises. The tendency for self-sufficiency in the economy has increased, as well as the tendency for protectionisme and reducing the role of exports.

2. Compare and contrast the integration processes before and after World War 2.

After the Great Depression in 30thies, and the WW2 in the middle of the XX century it was clear that the world economy can not function in a stable way without some mechanisms of coordination and management that are common for all countries . On the micro-level, companies started to create vertical systems of management and transformed eventually into multinational corporations (MNCs). On the macro-level there came a system of economic and financial organizations that regulated economic development – International Monetary Fund (IMF), World Bank, united Nations (UN), World Trade Organization (WTO).

In all, in the second part of the XX century the world economy transformed into something more than just a world economy ; it became international economy.

What exactly processes have been going in the world since the World War 2 that contribute to the development of the economi integration compared to the period before WW2 ?

Here we will discuss the most important of them :

- Favourable political conditions in the second part of 20th centrury1 - the fall of the colonial system and the necessity to set up a new economic order in the world, the end of the Cold War – allowed to consolidate the world economy as one whole system.

World War 22

The WW2, which was started by a block of agressive states with fascist Germany at the head ended with their complete defeat. After the war there came a change in the worlds correlation of forces. A range of countries in Europe and Asia fell apart from the capitalistic type of economy, such as Albania, Bulgaria, Eastern Germany, Hungary, Czechoslovakia, Yugoslavia, Vietnam and then China. After the WW2, the foundation was laid to divide the world into two opposing camps. This has defined the worlds politics and economic strategies for many years. The World War 2 has transformed into the « Cold War ».

Cold War3

The USA offered the « Marshall plan » economic help to a range of European countries not only to help with the reconstruction after the WW2 but also for the economic expansion of American monopolies in Europe. The implimentation of the Marshall plan involved 17 European countries, including Western Germany. After the beginning of Cold War against the socialistic countries the capitalistic countries headed for increased militarization, which resulted in the military buildup of the North Atlantic bloc (NATO), which was created in 1949. Apart from NATO, three other blocks were created – SEATO, CENTO and ANSUS. In this regard, the socialistic countries decided to establish their own military organization, the Warsaw Treaty Organization, which was created during their Warsaw meeting in May 1955.

The fall of the colonial system4

By the middle of the XX century the economic failure of the colonial system was finally revealed. The collapse of the colonial system has become one of the biggest events in the period after the WW2 and in the XX century as a whole. Already at the beginning of XX century the system of the direct colonial dependancy has exhausted all its opportunities. During the WW2, a number of countries have achieved the abolition of their colonial status and recognition of their independance. These countries were Afghanistan, Iran, Turkey, China. After the WW2, the disintegration of the colonial system has accelerated sharply. Originally the disintegration expanded in Asia and North Africa. In these regions at the end of the 1950ties 14 independant states were formed. Since 1960ties, Africa became a centre of the liberation movement and by the mid 1980ties 50 African countries achieved their status of independence.

Despite the fact that the reasons for the fall of the colonial system were different from a country to a country, there were a number of reasons that were common to all former colonies. These reasons were primarily the increasing dissatisfaction by the colonial rule caused by the increase of the taxes, increasing import of the foreign goods and export of the food products and raw materials, discrimination of the local people in everyday life, in education and when applying for a job. In a relatively developed countries in Asia the contradiction intensified between the foreign capital and the national sector, which got stronger during the WW2. All this has led to the formation of the anti-colonial union of the main social classes: peasantry, small bourgeoisie, national bourgeoisie, workes and intellectuals (lawyers, doctors, teachers, managers, etc.)

Decolonization went more or less peacefully in the majority of the countries (mostly in the British and French African colonies). But in a number of countries the liberation movement turned into a war – quick one line in Indonesia and long bloody ones like in Inchochina, Algeria.

The colonial countries were not able to achieve the support of the USA, which was striving for getting an access to the markets and attract the newly liberated countries to its side. So, these countries were on the side of decolonization. The existing military and political way of domination was becoming more and more useless and expensive. The integration within Europe was becoming more and more attractive compared to keeping the status quo with the colonies.

Independance allowed the former colonies to participate in the world politics, to become members of the UN. The low level of the economic development forced the newly liberated countries to cooperate with the developed countries, also with the former metropolies, which at the end contributed to the transformation of the colonializm into neocolonialism. Neocolonialism is a new way of dependancy where a new ways of domination - financial, economical – replace the old ones – military and political. The elements of the neocolonial policy were credits and loans, different types of help, price control on the raw materials, industrial and agricultural products on the world market, creation of the subsidiaries and joint ventures in the former colonies, etc. All this allowed the developed countries to reinforce their positions on the domestic markets of the former colonies and pump the resources out of the new states as well as to use cheap labour of the locals, have influence on the domestic and external politics of these countries, and in some of them to establish the necessary ruling regimes. Neokolonialism has caused the response actions from the side of the newly liberated countries, which were directed to reinforce their economic independence such as protectionists laws, development of the import substitution, nationalization of the foreign property, reinforced control on the foreign businessmen actions. At the international level the main manifestation of the desire for economic decolonization movement became the movement for then New International Economic Order (NIEO), which arose in 1974. The purpose of the movement was an equal economic cooperation with taking into account the special interests of the young liberated states by giving these states a number of preferential conditions, access to modern technologies, etc.

In the 1970ties it seemed that energy and raw materials crises will help the newly liberated countries to achieve the fulfillment of their claims. However, the transition of the

developed countries to energy-saving technologies, the interest of newly liberated countries in receiving foreign credits and loans, the divergence of interests within the block of the newly liberated countries allowed the developed countries of the world completely to block the implementation of the main provisions of the NIEO and to maintain control of the world economic relations. The practice has shown that the economic cooperation of the young countries with the wolrd leaders has a number of positive moments : creation of modern industries in the former colonies, accelaration of the modernization processes of the former colonies industry, saturation of their markets with goods, jobs creation.

- The growth and development of foreign direct investment (FDI) and multinational corporations (MNCs). Increase in the competition, which was caused by a considerable growth of manufacturing output, forced companies to search for the best operating conditions by growing over their national borders. This resulted in the raise of the foreign direct investment (FDI) and multinational corporations (MNCs).

Companies continued their growth by setting up new subsidiaries in the different relevant countries or by aquiring assets in foreign companies.

Foreign direct investment (FDI)

The main way the companies expanded internationally was through foreign direct investment (FDI). FDI involved owners of the capital that set up or acquired a manufactuirng unit in another country, over which they could excersise ownership and control. If before WW2 it was characteristic that capital flowed from the developped countries to the developing (funds flowed from the capital-abundant, industrialised countries of Europe and North America to the capital-scarce, less developped countries of Africa, Latin America and other member of British Empire), after WW 2 a growing proportion of the capital in the form of FDI flowed from one developed country to another one. The proportion of foreign investment going from the developed countries to the developing countries declined.

In the 1960ties FDI mainly took the form of investment by US companies in Western Europe. Much of it occurred in consumer goods industries, where the US companies had specific advantages as a result of their advanced innovation and superior marketing skills.

If we look at the period of time before WW1, the major part of the foreign investment was primarily market-seeking. But it did not often took the form of FDI. The colonial countries invested in colonies – in agriculture/plantations, minining industry, railways. After the World War 2 some part of the foreign investment was also of this kind but it was met by some general hostile attitude towards MNCs in some developing countries.

Multinational corporations (MNCs)

The role of MNCs is important. MNCs have existed for a long time, starting from the East-Indian trading company. In the past MNCs were mostly occupied with trade and therefore can not be considered the MNCs in the modern understanding of this concept. From the second part of the XX century, MNCs started to set up their subsiduaries not only in the developed countries, but also in the developing ones. The subsidueries were mostly specialized on the manufacturing of the same type of products as they did for the « national » country of MNCs mother company. As the time went, the MNCs subsiduaries change their orientation to the servicing the local demand and the local markets.

If earlier the world economy had to deal with the international cartels, today there are national companies that are big enough to lead their own external economic strategy. The terminolgy « multinational corporation » came into being in 1960ties.

Flow of investments from multinational corporations increased, but concentrated mostly in the richest regions of the world. While in 1970ties about 25% of foreign direct investment flew to developing countries, it is already at the end of 1980ties, their share had fallen below 20%.

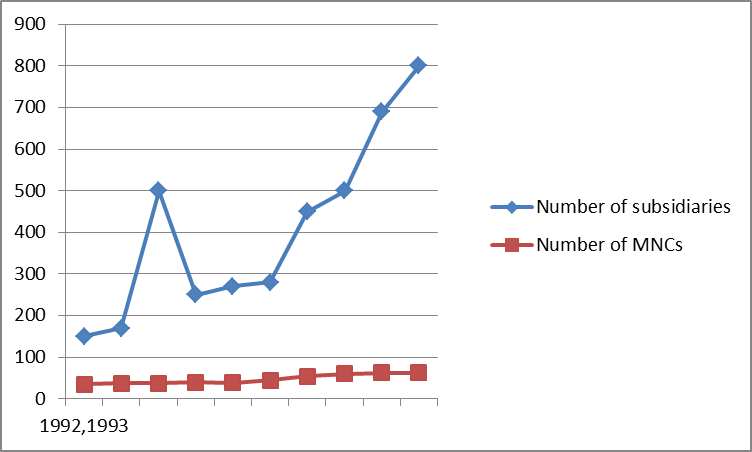

At the end of the XX century the main feature of the development of MNCs became to create a network of manufacturing facilities and sales on a global scale. Statistics show that the growth of foreign affiliates of MNCs is much faster than the growth in the number of MNCs themselves.

Table1. The growth of MNCs compared to the growth of subsidiaires

Source : http://www.mevriz.ru/articles/2001/6/947.html

Major role in the selection of countires for the creation of subsidiaries is played by the analysis of manufacturing costs, which are often lower in the developing countries; the demand and consumption structure, etc.

Intra-affiliate trade and intra-industry trade

An important feature of the MNCs is that a great deal of trade happens between the mother company and its subsidiaries and between different subsidiaries themselves. Such trade is known as intra-firm trade or intra-affiliate trade. This kind of trade accelarated significantly with the growth and development of MNCs, and is estimated to be one third of the total world trade.

Another important development of the period after the WW2 compared to the period before it became the intra-industry trade. A great deal of trade that takes place in manufactured products involves two-way trade in the same products. Countries both export and import products belonging to the same industry. The intra-industry trade has been increasing since after the WW2, the table below shows the Grubel-Lloyd index for intra-industry trade for OECD countries.

Table 2. The Grubel-Lloyd Index for Intra-Industry Trade in Manufactures, OECD Countries, 1970-85

|

Country

|

1970

|

1978

|

1980

|

1983

|

1985

|

|

Canada

|

0.663

|

0.687

|

0.645

|

0.737

|

0.764

|

|

United States

|

0.680

|

0.716

|

0.682

|

0.705

|

0.665

|

|

Japan

|

0.406

|

0.281

|

0.308

|

0.301

|

0.293

|

|

Australia

|

0.211

|

0.286

|

0.296

|

0.279

|

0.306

|

|

Belgium

|

0.800

|

0.835

|

0.841

|

0.875

|

0.867

|

|

Denmark

|

0.630

|

0.679

|

0.674

|

0.721

|

0.726

|

|

France

|

0.814

|

0.828

|

0.861

|

0.855

|

0.855

|

|

Germany

|

0.607

|

0.641

|

0.554

|

0.687

|

0.682

|

|

Ireland

|

0.444

|

0.600

|

0.685

|

0.723

|

0.703

|

|

Italy

|

0.617

|

0.614

|

0.696

|

0.662

|

0.695

|

|

Netherlands

|

0.741

|

0.759

|

0.779

|

0.776

|

0,763

|

|

United Kingdom

|

0.620

|

0.807

|

0.808

|

0.832

|

0.843

|

|

Austria

|

0.707

|

0.777

|

0.766

|

0.802

|

0.792

|

|

Finland

|

0.411

|

0.569

|

0.567

|

0.630

|

0.664

|

|

Norway

|

0.613

|

0.634

|

0.647

|

0.632

|

0.621

|

|

Sweden

|

0.630

|

0.653

|

0.681

|

0.706

|

0.719

|

|

Greece

|

0.283

|

0.415

|

0.396

|

0.462

|

0.463

|

|

Portugal

|

0.457

|

0.410

|

0.453

|

0.514

|

0.546

|

|

Spain

|

0.570

|

0.644

|

0.504

|

0.677

|

0.682

|

|

Turkey

|

0.154

|

0.120

|

0.223

|

0.359

|

0.468

|

|

Yugoslavia

|

0.638

|

0.647

|

0.688

|

0.700

|

0.700

|

|

Mean

|

0.546

|

0.590

|

0.598

|

0.639

|

0.645

|

|

Standard deviation

|

0.185

|

0.195

|

0.184

|

0.175

|

0.169

|

|

Coefficient of variation

|

0.339

|

0.330

|

0.307

|

0.274

|

0.262

|

Source: Greenaway and Hine, 1991/ Tradelecture 5, 2006/7

The table above shows that the mean level of intra-industry trade for several OECD countries rose from 54.6% in 1970 to 64.5% in 1985.

- New forms of investment. Capital markets developed a range of new more sophisticated products, a wider range of assests, in which investors could invest their money.

The most dynamic development happened for the stock exchange. In 1960ties there appeared a new type of securities such as Certificates of Deposit (CDs), which allowed trade of these certificates. In the case when a fixed deposit can not be closed early (and exactly what was the case in the U.S., which is home to certificates), the convertibility of the certificates is essential. Internet has contibuted enormously to the development of the securities trade. The official securities trade via Internet started in 1995 where the first on-line brokers appeared.

In 1980ies there was a growth of the derivatives trading and speculation– options, futures, swaps.

The internationalazation of the economy led to the formation of market of Euro notes.

Euro notes are securities issued in a foreign currency, which is foreign to the issuing country and which are placed among foreign investors for whom this is also a foreign currency. These securities include Euroequities and Eurobonds. This is a truly international market, which has no national boundaries and practically devoid of state control.

Thus, we can conclude that the development of the stock market has followed the development of the manufacturing processes, manufacturing needs and the overall economy. Internationalization and complexity of economic life has led to the internationalization and complexity of the stock market. There appeared new products like derivatives, there appeared new securities, new trading mechanisms as well as new participants of the securities market.

Techological progress that accelarated in the period of after the World War 2 has significantly increased the integration processes in the world and set a necessity of transicion from the model of economic independency and self-sufficiency to specialization on a country level within the frames of common world economy.

New achievements of the technological progress that allowed to create a totally new reliable world economic infrastructure – international transport system, communication systems (internet, wi-fi, 3G, 4G etc.), quick information exchange systems. Due to all this, the costs of transportation of goods and manufacturing factors have been reduced considerably, the level of economic risks have been reduced, the quicker and easier movement of labour between countries became possible as well as the quicker and easier movement of capital and technologies within the whole world.

These new achivement in the technologies are tightly connected with the growth and development of the MNCs. The integration of the new technologies and facilitation of the manufacturing operations, which gave the possibility to use the non-qualified or low-qualified labour created the opportunity for extensive fragmentation of the technological manufacturing procesess. Multinational corporations started to split up the manufacturing processes into several smaller processes and placed them in their different subsidiaries around the world. This has generated a huge increase in the international trade of components and other half-manufactured products. Another part of this development was to set up various services for after sales, warranty and installations.

So, there was an extensive decentralization of manufacturing processes on a global scale and concentration of control over them.

- Trade organizations, free trade agreements, etc.

One of the most important processes of the world economic integration during the after WW2 period and up to our days is the creation of various trade organizations, such as GATT (General Agreement on Tariffs and Trade) and then WTO (World Trade Organization) and free trade areas and customs unions, such as Europeen Union (EU), EFTA (European Free Trade Agreement), NAFTA (North American Free Trade Agreement), APEC (Asia Pasific Economic Cooperation) .

The General Agreement on Tariffs and Trade (GATT)5 came into being in 1947, its intention was to be temporary but it turned out the GATT remained for nearly fifty years, until it was taken over by a World Trade Organisation (WTO) in 1995. The GATT was not an organisation but a treaty that was signed by 23 countries. By the time of the Uruguay Round, there were 117 contracting parties, accounting for 80% of world trade. The GATT was an agreement, which set out a set of rules to govern trade between the contracting parties. The GATT did not seek to bring about free trade. The aim was to achieve freer trade through multilateral trade negotiations. A very important aspect of the GATT was the provision that it contained for resolving disputes that might arise between countries. A dispute could arise whenever one country considered that its rights had been nullified or impaired, as a result of a measures introduced by another country.

The World Trade Organisaion (WTO) 6is an organisation that intends to supervise and liberalize the international trade. WTO deals with regulation of trade between participating countries, it provides framework for negotiationg and formalizing trade agreements and dispute resolution process aimed at enforcing participants adherence to WTO agreements.

The creation of the WTO represented an important development in international trade policy over the past fifty years. The was a growing awareness that the GATT on its own was inadequate to cope with the demands being placed on it by the growth of world trade.

The European Union (EU) is an economic and political union of 28 member countries that are primarily located in Europe.The EU operates through a system of supranational independent institutions and inter-governmental negotiated decisions by the member countries. The EU has developped a single market through a standardised system of laws that apply in all member countries. The EU policies aim to ensure the free movement of people, goods, services and capital, enact legislation in justice and home affairs, and maintain common policies on trade, agriculture, fisheries and regional development.7

The Europen Free Trade Agrement (EFTA) and North American Free Trade Agreement (NAFTA). EFTA is a free trade organisation between four European countries – Liechtenstein, Iceland, Norway and Switzerland. It operates in a parallel with the European Union.

NAFTA is an free trade agreement signed by Canada, Mexico and the United States creating a trilateral rules-based trade bloc in North America. In terms of combined purchasing power parity GDP of its members as of 2007 the trade bloc is the largest in the world and second largest by nominal GDP comparison.8

Asia-Pacific Economic Cooperation (APEC) is a forum for 21 Pacific member economies that seeks to promote free trade and economic cooperation throughout the Asia-Pacific region. It was established in 1989 in response to the growing interdependence of Asia-Pacific economies and the advent of regional trade blocs in other parts of the world; to fears that highly industrialized Japan (a member of G8) would come to dominate economic activity in the Asia-Pacific region; and to establish new markets for agricultural products and raw materials beyond Europe (where demand had been declining). APEC works to raise living standards and education levels through sustainable economic growth and to foster a sense of community and an appreciation of shared interests among Asia-Pacific countries. APEC includes newly industrialized economies, although the agenda of free trade was a sensitive issue for the developing NICs at the time APEC founded, and aims to enable ASEAN economies to explore new export market opportunities for natural resources such as natural gas, as well as to seek regional economic integration (industrial integration) by means of foreign direct investment. 9

3. Conclusion

In the previous text we have made an effort to describe all the important processes of the economic integration in the world during the perioed from after the World War 2 and till our days and tried to compare and constrast them with the processes in the world before that period.

End WW 2

End of Cold War

The fall of colonial system, neocolonilism

Raise of MNCs

Technological progress

Fragmentation of manufacturing processes and intra-industry and intra-affiliate trade

free trade organizations, EU, GATT, WTO

- Integration and disintegration of the companies.

Integration

The process of the integration of companies needs also to be mentioned separately. The vertical and horizontal integration itself is not a new phenomenon in the world economy but the integration has increased significantly during the last 50 years.

Under the point about FDI they distinquish a market-seeking FDI, where an MNCs set up its subsidiaries in the search of new markets for its products. But there is also a so-called resource-based FDI, when an MNC sets up subsidiaries internationally in order to take advantage of cheaper resources in the foreign countries. These resources can be human resources (cheap labour, advanced R&D), easier access to raw materials, etc. In this case MNC that consists of a mother company and subsidiaries that operate in different countries at various stages of the manufacturing process is called a vertically-integrated MNC .

While talking about the vertical integration we understand a close cooperation between companies, when they unite starting from the level of a raw material manufacturer and ending at a chain of detail shops, selling the ready product to consumers.

While talking about the horizontal integration we understand a close cooperation between companies of the same industry.

While talking about the circular or mixed intergration of companies we understand the integration of the companies from various industries, which reduces the risks of non-systemati loss of earnings.

Disintegration

However, from the 1960ties and 1970ties, an important change occurred in the way

in which companies organised their manufacturing processes. Companies realised the potential cost advantages from separating some of the manufacturing processes or stages involved in the manufacturing of the products and performing these processes or stages in different countries. One form of this was the separation of the final assembly or processing stages, which were often labour-intensive, and moving these processes to the countries where there was a big supply of cheap unskilled labour. This was especially typicl for industries such as clothing and textiles, consumer electronic and industrials electronics. Such fragmentation of the manufacturing processes and moving them to different countries in the world is known as a vertical disintegration.

3. Conclusion

1 Tradelecture 1, 2006-7

2 http://knowhistory.ru/825-vremya-peremen.html

3 http://knowhistory.ru/825-vremya-peremen.html

4 http://www.istorya.ru/referat/25332/1.php

5 Tradelecture 9- 2006/7

6 Tradelecture 9- 2006/7

7http://europa.eu/index_da.htm

8 http://en.wikipedia.org/wiki/North_American_Free_Trade_Agreement

9 http://en.wikipedia.org/wiki/Asia-Pacific_Economic_Cooperation

18

Compare and contrast the process of global economic integration that has taken place over the past half century with that of previous periods in the history of the world